Annual Tax Assessment Notice

September 09, 2024

Ever wondered "Annual Tax Assessment Notice"? If so, you are in the right place. Annual Tax Assessment Notice is a critical factor to consider when making any major financial decision.

Editor's Notes: "Annual Tax Assessment Notice"have published today date. Due to its importance, we dedicate our time and effort doing some analysis, digging information, and made "Annual Tax Assessment Notice" we put together this guide to help target audience make the right decision.

FAQ

This FAQ section provides answers to frequently asked questions regarding the Annual Tax Assessment Notice. Understanding these details can help ensure a smooth and accurate tax assessment process.

Free Tax Assessment Appeal Letter Template - Edit Online & Download - Source www.template.net

Question 1: What is the purpose of the Annual Tax Assessment Notice?

The Annual Tax Assessment Notice informs property owners of the assessed value of their property, which is used to determine their property tax liability. It provides details such as the property's description, land area, and improvements.

Question 2: How is my property's assessed value determined?

Property assessments are typically conducted by local assessors using various methods, including market analysis, cost approach, and income approach. Factors considered include recent sales of comparable properties, cost of construction, and rental income.

Question 3: Can I appeal my property's assessed value?

Yes, property owners have the right to appeal their assessments if they believe them to be incorrect. The appeal process typically involves submitting a formal request to the local assessment board and presenting evidence to support the claim.

Question 4: What are the deadlines for property tax payments?

Payment deadlines for property taxes vary depending on the jurisdiction. It is important to check with your local tax authority for specific dates and payment options.

Question 5: What happens if I don't pay my property taxes on time?

Late payments may result in penalties, interest charges, and potential foreclosure proceedings in severe cases. It is crucial to make timely payments or contact your tax authority to explore payment plans if necessary.

Question 6: Where can I find more information about property tax assessments?

Property owners can obtain additional information by contacting their local tax assessor's office or visiting the official website of their county or municipality. These resources provide detailed guidelines, assessment procedures, and contact information for assistance.

Understanding the Annual Tax Assessment Notice and the property tax assessment process is essential for property owners. By addressing common concerns and providing clear explanations, this FAQ aims to empower taxpayers with the knowledge they need to navigate the process effectively.

For further inquiries or assistance, please don't hesitate to contact the relevant tax authorities or seek professional advice from qualified individuals.

Tips

For property owners, receiving the Annual Tax Assessment Notice can be both daunting and confusing. Here are some tips to help make this important process smoother and more understandable:

Tip 1: Review your notice carefully.

The notice contains important information about your property's value, assessment, and taxes due. Take time to review all the details thoroughly. If you have any questions, don't hesitate to contact your local tax assessor's office for clarification.

Tip 2: Understand your property's assessed value.

The assessed value is not necessarily the same as the market value. It is an estimate of your property's worth, based on factors such as comparable sales and property characteristics. If you believe your property's assessed value is inaccurate, you can appeal the assessment and request a reassessment.

Tip 3: Calculate your tax bill.

Your tax bill is based on your property's assessed value and the local tax rate. To calculate your tax bill, multiply your assessed value by the tax rate. You can find the tax rate for your area by contacting your local tax assessor's office or visiting their website.

Tip 4: Pay your taxes on time.

Property taxes are typically due in installments throughout the year. It is important to make your payments on time to avoid penalties and interest charges. You can usually pay your taxes online, by mail, or in person at your local tax assessor's office.

Tip 5: Explore options for tax relief.

In some cases, homeowners may be eligible for tax relief programs. These programs can reduce your tax bill or provide you with other benefits. Contact your local tax assessor's office to learn about any tax relief programs that may be available to you.

Annual Tax Assessment Notice

An Annual Tax Assessment Notice acts essentially as an official document from a government or taxing authority, informing a recipient of the amount of property tax they owe for a given year. It conveys important details about the assessed value, property details, and payment deadlines.

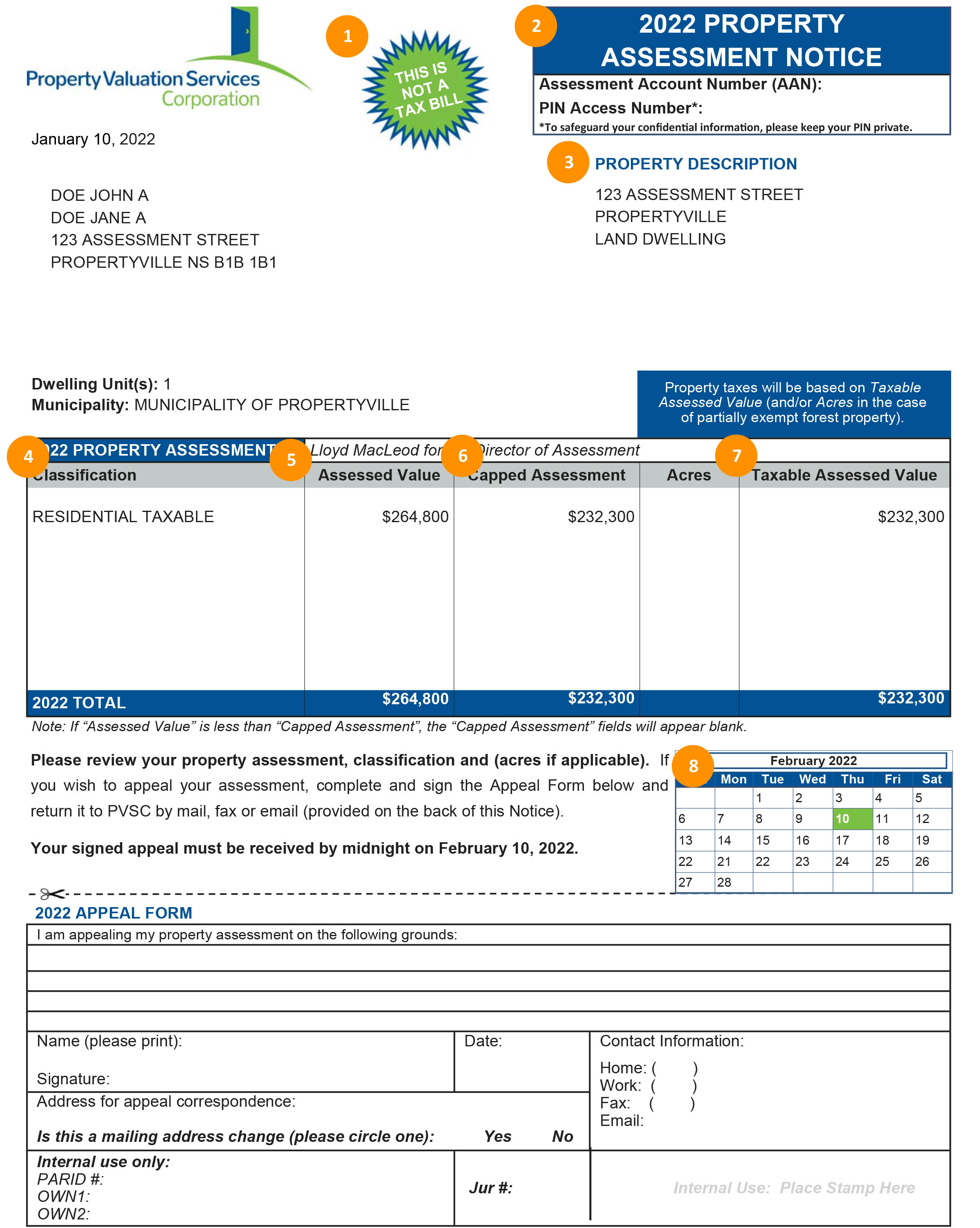

Your Property Assessment Notice | Property Valuation Services Corporation - Source www.pvsc.ca

- Valuation Assessment: Estimation of property value for taxation.

- Ownership Information: Identification of the property owner.

- Property Description: Details such as location, land area, and building type.

- Tax Amount: The sum of property tax, including any local assessments or fees.

- Payment Options: Methods for paying the tax, including due dates and penalties.

- Appeal Process: Information on how to dispute the assessment if deemed incorrect.

Accurate understanding of these key aspects is crucial. For instance, assessing property value helps determine fair taxation, while clear payment information ensures timely tax fulfillment. Moreover, knowing the appeal process empowers property owners to address any inaccuracies in the assessment. Thus, the Annual Tax Assessment Notice holds significant value, informing citizens of their tax obligations and contributing to a fair and equitable property tax system.

Property Assessments | Banff, AB - Official Website - Source banff.ca

Annual Tax Assessment Notice

An annual tax assessment notice is a document that is sent to property owners by their local government. The notice includes information about the property's assessed value, which is used to calculate the property's property taxes. The assessed value is typically based on the property's market value, but it may also include other factors, such as the property's size, location, and condition.

HomeBuilder Grant | RevenueSA - Source www.revenuesa.sa.gov.au

The annual tax assessment notice is an important document because it provides property owners with information about their property's value and how much they will owe in property taxes. Property owners should review their annual tax assessment notice carefully and contact their local government if they have any questions about the information on the notice.

Here are some tips for understanding your annual tax assessment notice:

- Review the assessed value. The assessed value is the most important piece of information on the notice. It is the value that is used to calculate your property taxes.

- Compare the assessed value to the market value. The market value is the price that your property would sell for on the open market. If the assessed value is significantly different from the market value, you may want to contact your local government to have the assessed value reassessed.

- Look for exemptions. Some properties are exempt from property taxes, such as churches, schools, and government buildings. If you believe that your property should be exempt from property taxes, you should contact your local government to apply for an exemption.

- Pay your property taxes on time. Property taxes are due on a specific date, which is typically listed on the tax assessment notice. If you do not pay your property taxes on time, you may be subject to penalties and interest.

Conclusion

The annual tax assessment notice is an important document that provides property owners with information about their property's value and how much they will owe in property taxes. Property owners should review their annual tax assessment notice carefully and contact their local government if they have any questions about the information on the notice.

By understanding the annual tax assessment notice, property owners can ensure that they are paying the correct amount of property taxes and that they are not missing out on any exemptions that they may be entitled to.

0 komentar