Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer?

Editor's Notes: "Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer" have published today date". It is important to understand this policy for everyone living in Germany or planning to move to Germany.

After doing some analysis, digging information, made Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer we put together this Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer guide to help target audience make the right decision.

.png)

Vincere Tax - How to Report Airbnb Income on Your Tax Return: A Step-by - Source www.vinceretax.com

Key differences or Key takeways

FAQ

This FAQ section provides comprehensive answers to frequently asked questions about income tax in Germany, as outlined in the Bundestag Einkommensteuer.

Question 1: What are the different types of income subject to income tax in Germany?

In Germany, all types of income are subject to income tax, including employment income, self-employment income, investment income, and rental income.

Question 2: What are the tax rates for income tax in Germany?

The tax rates for income tax in Germany vary depending on the individual's taxable income and marital status. The basic tax rate is 14%, and the top tax rate is 42%.

Question 3: Are there any deductions or exemptions that can reduce my income tax liability?

Yes, there are a number of deductions and exemptions that can reduce your income tax liability, including personal allowances, deductions for expenses related to employment, and deductions for charitable contributions.

Question 4: How can I file my income tax return in Germany?

You can file your income tax return in Germany online, by mail, or through a tax advisor. The deadline for filing your income tax return is May 31st of each year.

Question 5: What are the penalties for not filing my income tax return on time?

The penalties for not filing your income tax return on time can vary depending on the severity of the offense. Late filing fees, interest charges, and even criminal penalties may be imposed.

Question 6: Where can I get more information about income tax in Germany?

You can get more information about income tax in Germany from the German Federal Ministry of Finance, the German Taxpayers' Association, and various online resources.

Understanding the intricacies of the German income tax system can be daunting, however, seeking professional advice from a tax advisor is recommended to ensure compliance and optimize tax savings.

Tips

Navigating Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer can be a complex task. Consider these tips to simplify your tax filing:

Tip 1: Gather your documents. Before you begin, ensure you have all necessary documentation, including payslips, income statements, and supporting receipts.

Tip 2: Determine your residency status. Residency status significantly impacts tax liability. Understand the different residency categories and their implications.

Tip 3: Calculate your taxable income. Subtract allowable deductions and exemptions from your gross income to arrive at your taxable income.

Tip 4: Apply the appropriate tax rate. Germany's progressive tax system applies varying rates based on income brackets. Consult the current tax tables for your applicable rate.

Tip 5: Claim eligible deductions and credits. Utilize deductions and credits to reduce your tax liability. Common deductions include business expenses and charitable contributions.

Tip 6: File on time. Adhere to the established tax filing deadlines to avoid penalties. Consider filing early to allow ample time for processing.

Tip 7: Seek professional assistance if needed. For complex tax situations or if you encounter confusion, do not hesitate to consult a tax advisor or professional accountant.

By following these tips, you can navigate Germany's tax system efficiently and ensure accurate tax filing.

Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer

Understanding the German Income Tax (Einkommensteuer) is essential for individuals and businesses operating in the country. This guide presents six key aspects to consider:

- Progressive System: Tax rates increase with higher income levels, ensuring a fair distribution of tax burden.

- Deductions and Allowances: Various expenses and allowances can be deducted from taxable income, reducing the overall tax liability.

- Taxable Income Categories: Income is classified into different categories, each taxed at specific rates.

- Solidarity Surcharge: An additional surcharge is levied on higher earners to support social programs.

- Church Tax: Church members are subject to an additional tax supporting religious organizations.

- Tax Avoidance and Evasion: Strict penalties are imposed for attempts to avoid or evade paying taxes.

These aspects provide a comprehensive understanding of the German Income Tax System. Businesses and individuals can benefit from optimizing deductions, understanding the progressive tax structure, and adhering to tax laws to minimize tax liabilities while contributing to the country's fiscal system.

Germany tax News 2024,Germany Income Tax,Germany Tax Rates,Eonomy - Source www.worldwide-tax.com

Income Tax In Germany: Comprehensive Guide To The Bundestag Einkommensteuer

The German Bundestag is responsible for passing laws that govern the country's income tax system. The Einkommensteuergesetz (EStG) is the most important law in this regard, and it sets out the rules for calculating taxable income, determining tax rates, and granting deductions and allowances.

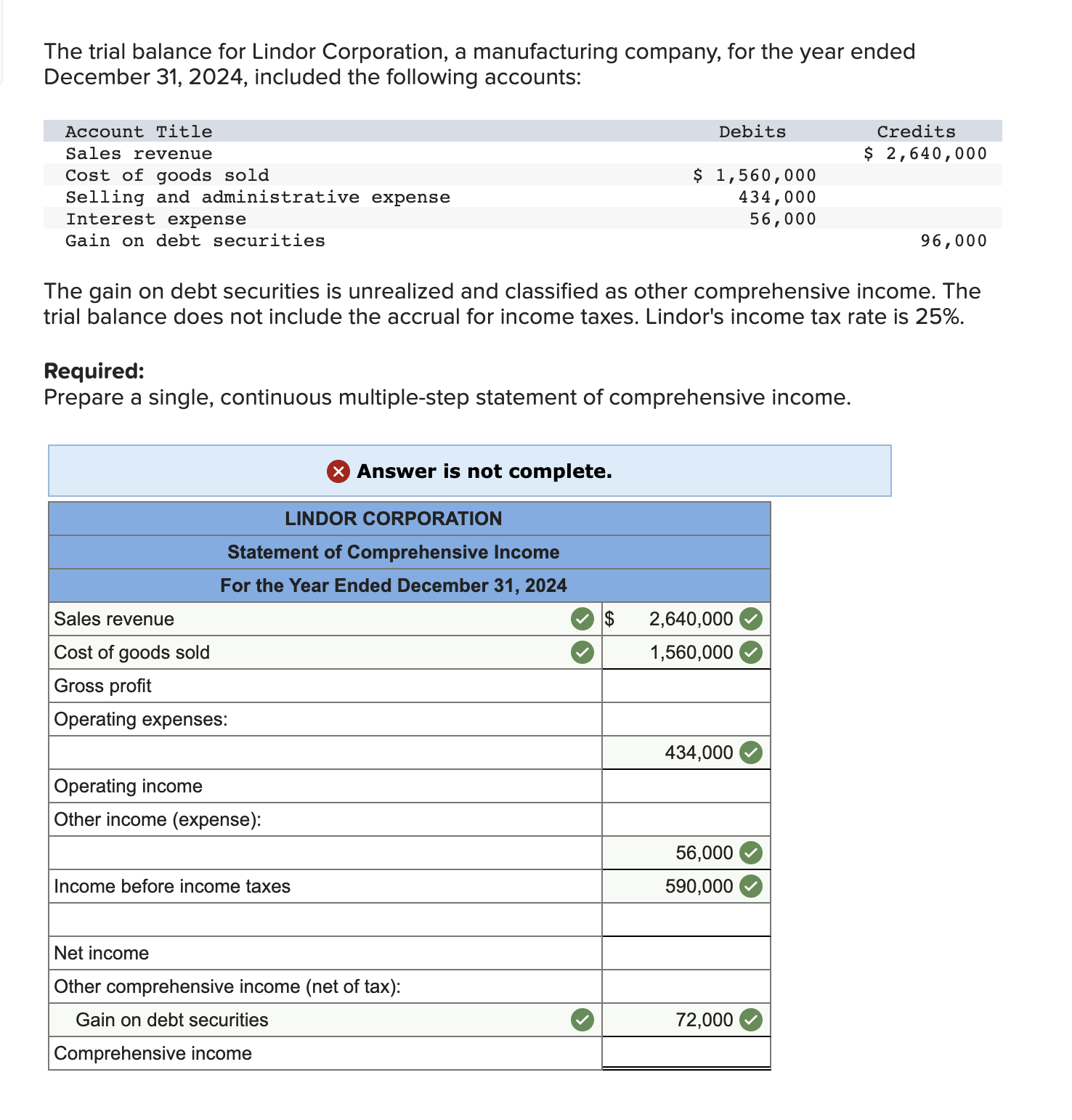

Solved The trial balance for Lindor Corporation, a | Chegg.com - Source www.chegg.com

The Bundestag also has the power to amend the EStG, and it does so regularly in response to changes in the economy and社会. As a result, it is important for taxpayers to stay up-to-date on the latest changes to the income tax law.

The income tax system in Germany is a complex one, and the Bundestag Einkommensteuer is a key component of it. By understanding the connection between these two, taxpayers can better understand their tax obligations and plan for the future.

The Bundestag Einkommensteuer is a progressive tax, which means that the tax rate increases as taxable income increases. The tax rates are set by the Bundestag, and they are subject to change each year. The current tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 9,984 euros | 14% |

| 9,985 - 58,597 euros | 23% |

| 58,598 - 265,327 euros | 35% |

| Over 265,327 euros | 45% |

Taxpayers are also entitled to a number of deductions and allowances, which can reduce their taxable income. These deductions and allowances are set by the Bundestag, and they are subject to change each year.

The Bundestag Einkommensteuer is a complex tax, but it is also a fair and efficient one. By understanding the connection between the Bundestag and the Einkommensteuer, taxpayers can better understand their tax obligations and plan for the future.

Conclusion

The Bundestag Einkommensteuer is a key component of the German tax system. It is a progressive tax, which means that the tax rate increases as taxable income increases. The tax rates are set by the Bundestag, and they are subject to change each year. Taxpayers are also entitled to a number of deductions and allowances, which can reduce their taxable income.

By understanding the connection between the Bundestag and the Einkommensteuer, taxpayers can better understand their tax obligations and plan for the future. The Einkommensteuer is a complex tax, but it is also a fair and efficient one.